Airdeed Homes Study Reveals Top States, Cities for Long-Term Rental Property Investment

Airdeed.com, an online short-term rental real estate marketplace, recently conducted a homes study revealing the top states and cities for long-term rental property investment.

Airdeed.com, an online short-term rental real estate marketplace, recently conducted a homes study revealing the top states and cities for long-term rental property investment. Real estate investors looking for long-term rental properties that would fetch them lucrative rentals must consider investing in properties in these top states and cities, as identified by the Airdeed Homes Study. Airdeed analyzed more than 1,000 long-term rental investment properties for sale. With the help of statistical analysis and manual techniques, the study showed the most profitable income options for buyers.

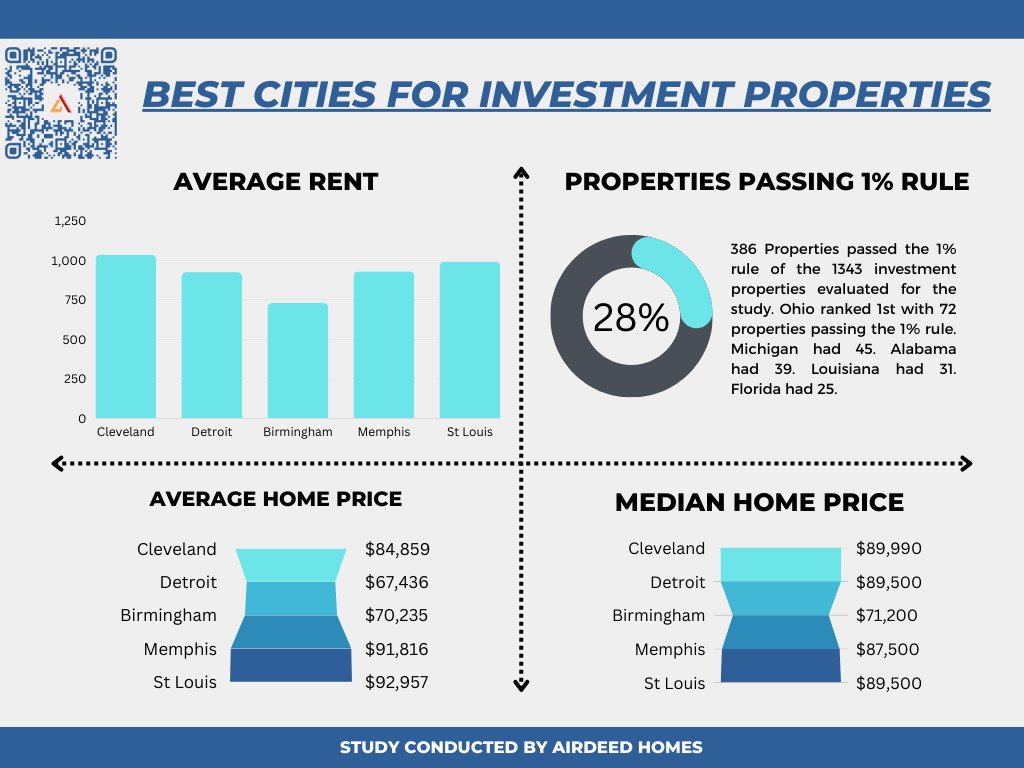

The main focus of the Airdeed Homes Rental Property Report was long-term rentals as opposed to Airbnb and other short-term rental properties. The top 10 states, as identified by the Airdeed Homes Study, are Ohio, Michigan, Alabama, Florida, Texas, Louisiana, Georgia, Illinois, Tennessee, and Missouri. One main reason these states topped the chart is their expansive selection of properties with investment opportunities. The second major reason is their impressive gross-revenue-to-list-price ratios.

When it comes to the top 10 cities in the nation, the following cities showed the highest gross revenue returns: Cleveland, Detroit, Birmingham, Memphis, St Louis, Dallas, Lubbock, Akron, Lake Charles, and Milwaukee. These 10 cities offered great opportunities to make a steady profit, according to the Airdeed Homes Rental Property Report. A total of 50 rental properties listed exceeded at least 15% gross return to cost. Ohio ranks on top of the list, with 91 rentals exceeding a 10% gross-revenue-to-list-price ratio, followed by Michigan and Alabama offering 53 and 50 rental properties, respectively. Florida and Texas recorded 45 and 42 rentals exceeding 10% gross-revenue-to-list-price ratio, and Louisiana, Georgia, and Illinois followed suit. The analysis excluded investment properties for sale with less than 10% gross revenue to list price ratio.

Airdeed Homes Rental Property Report used data from multiple listing services and sanitized it to ensure accuracy and completeness. This research brings some crucial insights for real estate investors. Airdeed analyzed more than 1,300 rentals to provide investors with the most profitable income options. It will continue to conduct more such studies to help investors with better investment properties for sale. It is advisable that investors choose a property that has strong rental potential and is located in desirable areas with low vacancy rates. They should also familiarize themselves with investment property capital gains tax and depreciation of investment property.

To learn more, visit https://airdeed.com/investment-property-for-sale/best-states-top-cities/.

About Airdeed

Airdeed is a leading short-term rental buying and selling marketplace online. Whether it is Airbnb or VRBO properties, it offers a new and easy way to reach investors searching for properties in the area. The website does not charge any fee for listing the properties, and sellers can save at least 2%–3% on listing fees on other realtor websites or agents.

###

Media Contact

Airdeed

Phone: 904-200-5492

Email: Support@airdeed.com

Website: https://airdeed.media/