Silver Bullion Launches P2P Loans With Silver As Collateral

Silver Bullion Pte. Ltd. lists the attractive interest rates on the loans

Silver Bullion has launched P2P loans with silver as collateral and offered critical information about current interest rates for borrowers at Silver Bullion Pte. Ltd.

Gregor Gregerson founded Silver Bullion in 2009 in the city-state to leverage Singapore’s brilliant jurisdiction protection. Since then, it has gone from strength to strength, developing strong protections against the systemic risks of counterparty, currency, and jurisdiction. Moreover, Silver Bullion Pte. Ltd. offers state-of-the-art storage facilities, reliable bullion testing, optimal insurance, deep buy/sell liquidity, collateralization, and digitization for the benefit of users.

By constantly evolving in keeping with changing times and customers’ requirements, it has hit the right spot with them. That’s how Silver Bullion has become the trusted resource for buying, selling and dealing with precious metals. And now understanding people’s needs, it has launched secured Peer To Peer loans that they can make the most out of. Silver Bullion Pte. Ltd. is a platform where people can borrow their metals whenever needed. It’s interesting to note that metal is used as collateral for these loans that are available at attractive rates.

Silver Bullion has taken on the onus of matching borrowers with lenders who have extra funds (fiat). The loan scheme works brilliantly for lenders as well because they can get returns on their extra fund with minimum risk. Silver Bullion Pte. Ltd. offers all the crucial information borrowers and lenders need to make the most out of this P2P loan option. From the overview of what the loan scheme entails to what is needed of borrowers and lenders is clearly stated on the platform.

One of the highlights of these peer-to-peer loans is that it is possible to set the interest rate based on users’ choices. They have the flexibility they need from choosing between different currencies to duration. Once they have set these parameters, people can post on Silver Bullion platform how much they are willing to borrow or lend. A contract is created when two parties agree on the terms and conditions. These P2P loans are secured by 200% worth of precious metals and EV metals. Lenders’ funds are secured at a 2:1 ratio by the borrower’s metal, which is stored in Silver Bullion’s secure vault.

Thus without the need for any middlemen, these loans can be completed to suit both parties. At Silver Bullion, people can find the latest interest rates on different metals to make their best decisions. The platform also takes them through the simple steps of opening a S.T.A.R storage account, which is free and doesn’t require buying bullion, to creating the loan contract when both parties are agreeable.

To learn more about these loans and other offers at Silver Bullion, one can visit https://www.silverbullion.com.sg/Loans.

About Silver Bullion Pte. Ltd.

Founded in 2009, the company offers solid protections against the systemic risks of counterparty, currency, and jurisdiction, while also providing excellent storage facilities, reliable bullion testing, optimal insurance, deep buy/sell liquidity, collateralization and digitization.

###

Media Contact

Silver Bullion Pte. Ltd.

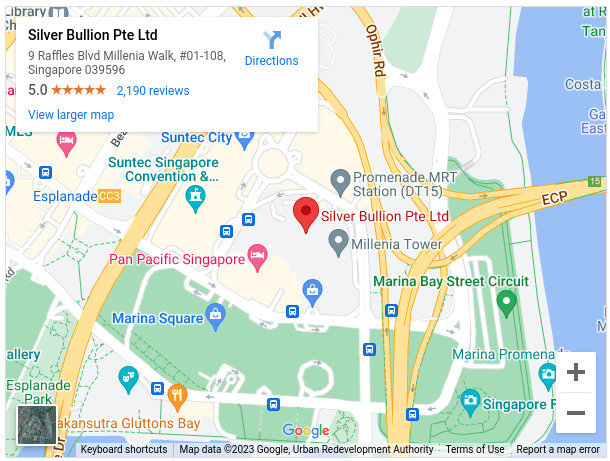

Address: 9 Raffles Boulevard #01-108, Millenia Walk, Singapore 039596

Phone: +65 6100 3040

URL: https://silverbullion.com.sg/

Disclaimer:

This is not an endorsement or recommendation. All investments carry significant risk and all investment decisions of an individual remain the specific responsibility of that individual. There is no guarantee that it will result in profits or that it will not result in a full loss or losses All investors are advised to fully understand all risks associated with any kind of investing they choose to do.

There is no offer to sell, no solicitation of an offer to buy, and no recommendation of any security or any other product or service in this article. Moreover, nothing contained in this PR should be construed as a recommendation to buy, sell, or hold any investment or security, or to engage in any investment strategy or transaction. It is your responsibility to determine whether any investment, investment strategy, security, or related transaction is appropriate for you based on your investment objectives, financial circumstances, and risk tolerance. Consult your business advisor, attorney, or tax advisor regarding your specific business, legal, or tax situation.

This press release may contain forward-looking statements. Forward-looking statements describe future expectations, plans, results, or strategies (including product offerings, regulatory plans and business plans) and may change without notice. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements.

newsroom: news.38digitalmarket.com